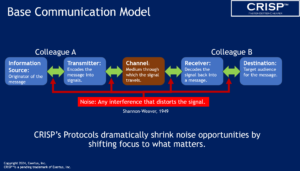

M&A integrations are often plagued by miscommunication. Miscommunication occurs when any of several different events happen. Technical issues with mobile phone service, internet access/quality, or voice/email delivery can all contribute to breaks in the Channel segment of Shannon-Weaver’s base communication model. But fortunately, with today’s technology, those problems are minimal for the majority of initiatives.

For M&A transactions, the root cause of miscommunication lies in the overwhelming noise that is typically present in the process. This noise is self-inflicted. It comes from unnecessary meetings, chaotic or misleading email chains, redundant requests for data, conflicting processes, and arbitrarily siloed information retarding timely access.

For M&A transactions, the root cause of miscommunication lies in the overwhelming noise that is typically present in the process. This noise is self-inflicted. It comes from unnecessary meetings, chaotic or misleading email chains, redundant requests for data, conflicting processes, and arbitrarily siloed information retarding timely access.

The result? Individual contributors are left navigating through a mess of distractions affecting their ability to focus and taking time away from what really matters: executing their specific role in the integration effectively.

Let’s break down some of the most common sources of communication noise and see how they create unnecessary barriers for individual contributors during M&A integrations.

- Unnecessary or Duplicative Meetings

In many integrations, interim status meetings or requirement-gathering sessions consume valuable time that could be spent on execution. Individual contributors often find themselves in back-to-back meetings, most of which provide little relevant or timely information for the actual work they need to do.

In many integrations, interim status meetings or requirement-gathering sessions consume valuable time that could be spent on execution. Individual contributors often find themselves in back-to-back meetings, most of which provide little relevant or timely information for the actual work they need to do.

Example: IT Function

For instance, the IT SMEs may be pulled into a daily status meeting meant to “keep everyone in the loop,” but these meetings often rehash the same updates and decisions, and contain little, if any, content of relevance to all participants. And the larger the team the greater the odds of this happening. The noise from these types of redundant meetings is very expensive; calculate what the hourly cost of these meetings are for your organization for an actual value. Plus, they not only waste time but also raise frustration levels.

- Chaotic Email Chains and Misleading Subject Lines

Reply-all email threads can be another source of confusion and noise in M&A transactions, as can misleading or ambiguous subject lines. When an email needs to be opened and inspected to determine what it contains, it takes time. When potentially critical data becomes buried under rafts of unrelated comments or questions, risk that it will remain hidden increases.

Reply-all email threads can be another source of confusion and noise in M&A transactions, as can misleading or ambiguous subject lines. When an email needs to be opened and inspected to determine what it contains, it takes time. When potentially critical data becomes buried under rafts of unrelated comments or questions, risk that it will remain hidden increases.

Example: Finance Function

Consider a situation where a finance SME is working on reconciling accounts across the Buyer and Seller entities. An email chain to a small group, initially discussing account mapping may spiral into tangential conversations unrelated to the original subject line, and crucial updates about reconciliation might get pushed deeper into the thread. The finance analyst has to wade through dozens of irrelevant emails to find the one key piece of data they need to finalize reconciliation. In a worst-case ending, by the time the correct information is found, deadlines are missed, penalties are incurred, and frustration mounts.

- IM/DM Interruptions Requesting Data

Instant messaging (IM) or direct messaging (DM) tools are designed to make communication faster and often introduce more interruptions than productivity. But perhaps more important than interruptions, is that exchanges through IM tools to get data, potentially: 1) create alternative sources of truth, 2) isolate data that should be available to a wider audience. The impact of this activity can have material cost, quality and time consequences depending on the context data.

Instant messaging (IM) or direct messaging (DM) tools are designed to make communication faster and often introduce more interruptions than productivity. But perhaps more important than interruptions, is that exchanges through IM tools to get data, potentially: 1) create alternative sources of truth, 2) isolate data that should be available to a wider audience. The impact of this activity can have material cost, quality and time consequences depending on the context data.

Example: HR Function

An HR SME may be working on consolidating employee benefits between the Buyer and Seller, which requires intense focus and careful documentation. They are also the sole source of information for compliance and people movement. During the consolidation effort, they’re hit with IMs from multiple people asking for updates on personnel transfers or compliance documentation.

Each IM ping disrupts their flow, creating more room for error and slowing down their progress with consequences for the transaction. Additionally, each repetitive answer creates another source of truth. When the answer to “where did this outdated data come from” is, an “IM from _______”, this triggers another series of interruptions and delays to fix the problem.

- Process Bias: Administrative and Organizational

Organizational bias in administrative processes creates another layer of noise. While some processes are based on regulatory mandates and have narrow compliance steps, many are purely in place for the convenience of the specific functional unit to carry on their daily activities. In an important number of cases, these processes were not designed to accommodate the scale or speed that M&A transaction terms and conditions demand. This is especially true where the volume of work is typically distributed over timeframes far in excess of transaction constraints, using fully burdened personnel.

Organizational bias in administrative processes creates another layer of noise. While some processes are based on regulatory mandates and have narrow compliance steps, many are purely in place for the convenience of the specific functional unit to carry on their daily activities. In an important number of cases, these processes were not designed to accommodate the scale or speed that M&A transaction terms and conditions demand. This is especially true where the volume of work is typically distributed over timeframes far in excess of transaction constraints, using fully burdened personnel.

Example: Legal Function

In the legal function, miscommunication often results from process biases built into organizational structures. Lawyers are often required to adhere to stringent documentation standards, which can introduce delays if not aligned across the Buyer and Seller entities.

For instance, the Buyer’s legal team may need specific Seller documentation for compliance purposes. However, the Seller’s process requires multiple layers of legal approval before they can release the documents. While both legal teams are operating within their respective organizational processes, the different timelines and approval steps create a barrier to smooth communication. The Buyer’s legal team is left waiting, unsure when—or if—they will get the information they need to finalize regulatory filings, potentially causing delays in closing.

- Multiple Sources of Truth and Siloed Data

One of the biggest contributors to the detriment of successful M&A integrations is the presence of multiple, conflicting sources of truth. It’s easy to see why. With individual contributors operating in separate functional units and multiple entities, having both isolated and overlapping data sets relevant to the initiative, and exchange that data through a variety of methods and channels, the probability of distortion and timing/synchronization differences leading to miscommunication increases with the scope of the transaction.

One of the biggest contributors to the detriment of successful M&A integrations is the presence of multiple, conflicting sources of truth. It’s easy to see why. With individual contributors operating in separate functional units and multiple entities, having both isolated and overlapping data sets relevant to the initiative, and exchange that data through a variety of methods and channels, the probability of distortion and timing/synchronization differences leading to miscommunication increases with the scope of the transaction.

Example: Advertising/Marketing Function

Advertising and marketing teams are especially vulnerable to this type of noise, as they often work across numerous platforms and databases.

For example, during the integration of two companies’ marketing departments, both the Buyer and Seller have their own sets of customer data, performance metrics, and creative assets, housed in different systems. A marketing SME may need to pull data for a unified campaign, only to find discrepancies between the two databases. The Buyer’s CRM shows one version of customer segmentation, while the Seller’s marketing automation platform shows another. The lack of a single source of truth creates confusion, delays decision-making, and risks launching campaigns based on inaccurate information.

Conclusion

CRISP’s communication framework is designed to minimize noise-related miscommunication caused by unnecessary meetings, chaotic email chains, redundant requests, conflicting data, and process bias. Using purpose built protocols and streamlined artifacts, focusing on individual contributors’ needs, delay, cost and quality issues can be reduced ensuring smoother, faster, and more effective M&A integrations.

Now that we’ve addressed the most typical root causes of communication breakdowns, it’s time to dive into how traditional management approaches are less than optimum when it comes to executing M&A transactions.. In Post #4, we’ll explore how these shortcomings can be overcome with a shift in perspective,.

Thanks for reading! If this post has sparked any new ideas or questions about how to optimize your M&A integrations, I invite you to join one of my live intro sessions. Each session is 30 minutes and limited to 2 participants for an interactive, in-depth look at how the CRISP™ method can make your next integration faster, better, and more efficient.

📅 Register here -> CRISP™ Intro Sessions

✉️ Want to stay updated on future posts and sessions? Opt-in for exclusive updates: CRISP™ site

Let’s continue the conversation and dive deeper into a transformative approach to successful M&A execution!

CRISP™ is a pending trademark of Exertus, Inc.