Accountability, Clarity, and Efficiency

Hopefully in the first 4 posts in this series you saw that individual contributors are the critical elements to executing successful M&A transactions, despite being hobbled by incessant miscommunication and noise. And that by shifting the focus to a communication-centric approach major improvements to the entire process can occur.

In this post, we’ll explore why concentrating on and testing for accountability, clarity, and efficiency can dramatically improve outcomes, allowing transactions to occur faster, better and at reduced cost.

Accountability

Shutterstock

In a traditional project RACI matrix (Responsible-Accountable-Consulted-Informed), accountability is separated from responsibility to distinguish between those people who are doing the work (responsible) and those in charge of making sure the work gets done, hopefully on-time and at an expected levels of quality (accountability). Organization-wise, this perspective easily supports the notion of a hierarchy and ultimately a chain-of-command structure. Good for after-the-fact management, not so good for real-time in-flight work.

In reality, while satisfying your boss on a daily basis is an important thing, unless the boss is actually doing something that directly requires a deliverable you produce, effort expended purely or partially for that purpose takes time and attention away from working on the initiative.

Clarity

Storyblocks

How often has this happened to you: you are participating in a “let’s get everybody on the same page” meeting where aspirational goals and strategic objectives are covered in great detail. At the end of the meeting (and for probably a good portion of it), a nagging thought persists: “… this is all well and good, but what exactly is my part and when will I get what I need to complete it within what I understand the timeframe to be.” This type of meeting, and others like it, typically focus on either future-state, enterprise-level content, or marginally-relevant Workstream data.

Individual contributors, often burdened with performing their “day jobs” in addition to new transaction activities, have little time or use for this information, especially if it is also available in a press release or internal company communique.

Efficiency

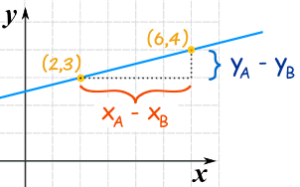

Most everyone remembers the basic geometric concept that the shortest distance between two points is a straight line. We subconsciously incorporate that concept into our daily lives, often forgetting about it until we find ourselves making the same trip twice or taking an unnecessarily convoluted route. In the context of an M&A initiative, intentionally applying this concept to organizational structures typically exposes inefficient or non-existent/dead end communication paths.

In traditional hierarchies, straight lines exist in siloed, vertical layers of employees, often referred to as “spans” of control. Under this design, communication efficiency is poorest (most convoluted) when strict adherence to the hierarchy is part of the culture and not mandated by external entities. Think multiple approval or review layers/steps. But what about matrixed organizations? Doesn’t that solve the problem?

It might, but usually doesn’t. Organizational designs, hierarchical, matrixed, or hybrids, are designed for administrative control, not the on-the-ground communication efficiency needed for fast and nimble transaction activities.

Summary

Keeping a sharp focus not on what people need to do (tasks), but what they need to have in order to deliver those things provides immediate benefits.

- Accountability – changing the dynamic so that contributors responsible for delivering their pieces are first accountable to their colleagues who are depending on them, then to their bosses (or Workstream leads), shifts the emphasis to getting things done, and away from satisfying non-value added (at the initiative level) interim or unrelated deliveries.

- Clarity – intentionally limiting the amount of information contributors are presented by letting them articulate exactly what they need and when they need it, significantly reduces the necessity for unproductive (from the contributor’s viewpoint) alignment meetings and promotes the efficient use of time and resources to achieve specific deliverables.

- Efficiency – by rethinking how lines of communication can be drawn such that all contributors needing to exchange critical information (produce or consume), have direct, straight-line access to that information as soon as it’s available, by definition will compress the communication time, eliminate intermediaries, and minimize potential misunderstandings.

With a proper structured approach, doing these things will dramatically improve timelines and deliverable quality, and as a by-product, reduce execution cost.

Continuing to build on these principles, in the next post you will see how the CRISP™ Method ensures contributors receive exactly what they need, precisely when needed. Discover how this communication-centric approach can transform your M&A initiative execution by reducing inefficiencies and enhancing productivity.

Thanks for reading! If this post has sparked any new ideas or questions about how to optimize your M&A integrations, I invite you to join one of my live intro sessions. Each session is 30 minutes and limited to 2 participants for an interactive, in-depth look at how the CRISP™ method can make your next integration faster, better, and more efficient.

📅 Register here -> CRISP™ Intro Sessions

✉️ Want to stay updated on future posts and sessions? Opt-in for exclusive updates: CRISP™ site

Let’s continue the conversation and dive deeper into a transformative approach to successful M&A execution!

CRISP™ is a pending trademark of Exertus, Inc.