Recap and Intro

So far, the M&A execution topics covered in this series have been:

- Individual contributors are the key to success

- M&A transactions are complicated, but with known parameters

- Miscommunication is the largest single contributor to execution issues

- Classic approaches are not communication-centric

- Accountability, clarity and efficiency (ACE) are necessary for trouble-free execution

- The CRISP™ Method embeds ACE using its Nexus Point approach

This post discusses in broad terms what an Integration Management Offices does, the challenges it faces and how adopting the CRISP™ Method as a foundation can benefit all transactions and the IMO itself.

The Purpose of the IMO

Organizations that are involved with supporting M&A transactions go by many names:

- Transition Office

- Integration Office

- M&A Integration Office

- Post-Merger Integration (PMI) Office

- Transaction Management Office

- Corporate Integration Office

- Business Integration Office

- Transformation Office

- Deal Integration Office

- Change Management Office

- Synergy Management Office

- Strategic Integration Office

- M&A Execution Office

- Operational Integration Office

- Enterprise Integration Office

While the names, transactions and context may vary, the mission is consistent: to execute the transaction according to deal terms as efficiently as possible for all involved. For brevity, “IMO” is the term used here to collectively identify these variously-named organizations.

Core Responsibilities

Most IMO’s have an expansive but limited set of critical responsibilities.

- Oversight of integration activities: the nuts and bolts of getting things done including timeline adherence.

- Ensuring alignment with: the original deal terms and conditions, execution cost and expense recapture goals, cultural integration, and operational continuity.

- Facilitation of cross-functional and cross-entity communication resulting in the coordination of people and assets across all involved parties: Buyer, Seller, and Advisors.

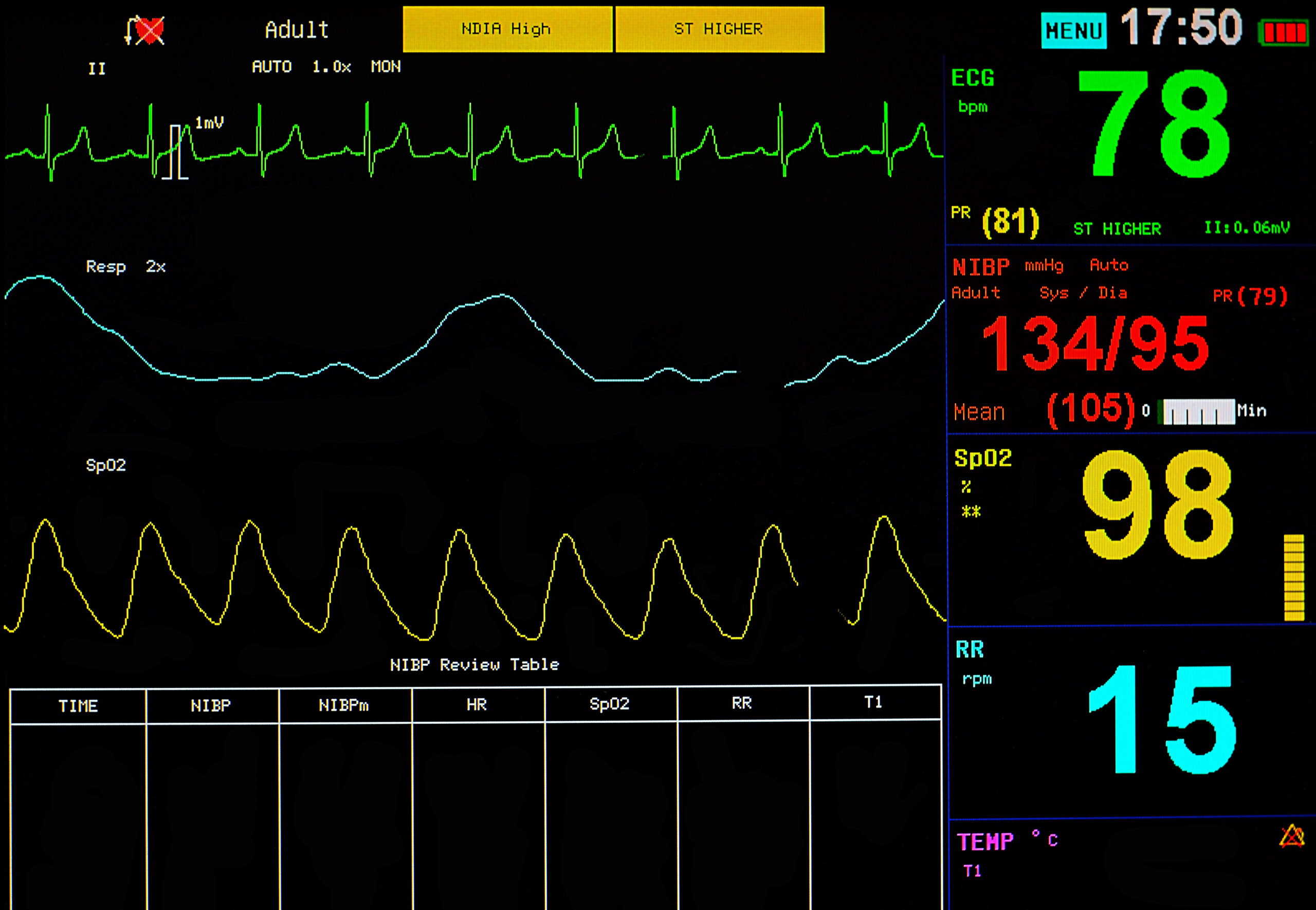

At both micro and macro levels, efficiently fulfilling these responsibilities depends on the detail and speed of visibility into the actions of the people doing the work. The effectiveness of that visibility is affected not only by the policy and process decisions of the IMO, but also by the individual work-streams. The most common method of “visibility” across the initiative is through recurring status reports and meetings, sometimes augmented with derivative dashboards or loosely defined emails/direct messages.

As you’ll see next, while the specific initiative details change, the underlying dynamic of this approach, from the IMO’s perspective, is firmly rooted in a sub-optimized after-the-fact inspection / reaction loop.

Challenges Faced by the IMO

The major challenges faced by IMOs are not dissimilar to challenges facing any large scale initiative:

- miscommunication in all its forms

- process bottlenecks or deserts

- resource allocation issues

But IMOs also have a unique challenge most enterprise projects or programs lack – timely performance tied to legal agreements with serious consequences for non-compliance.

Internal initiatives not involving time-constrained regulatory mandates, like an ERP update or rolling out a new benefit program, while complicated, rarely have the same potential financial or organizational impacts that come as a result of delays or rework. For M&A transactions, they can also create significant costs in the form of performance penalties and possible added legal exposure.

Unfortunately, traditional approaches and tools are not configured out of the box to support this performance requirement. This is particularly true of collaboration tools that are used on an ad hoc, best effort basis.

Further, the amount of administrative overhead in the form of low value-add mechanisms like time recording and status reporting continually shift the focus of contributors away from delivering what’s needed to move forward, to producing information that is, by its very nature, out of date as soon as it is created. Compounding the problems inherent with this approach is the effort the IMO must expend to ensure the dated material is available before it needs it to be reviewed and repackaged for communication elsewhere.

Of course this is a generalization, but not without considerable historical precedent and obvious communication delays caused by cascading information hand-offs. And unfortunately, time and money invested using this technique rarely reduces the opportunities for miscommunication or provide a path to any meaningful process change. Which also means insights into resource allocation by the IMO (or any of the work-streams) in this context, are often too little – too late relative to the work that needs to be done within a known deadline.

Solving for these time and performance problems leads to a natural conclusion: precise, real-time information to maintain momentum and enable proactive action to prevent setbacks is needed. But not if its collection and review further burdens the IMO or contributors.

How CRISP Supports IMO Objectives

CRISP™’s structured approach to communication, accountability, and resource allocation directly supports the IMO’s mandate: to execute the transaction according to deal terms as efficiently as possible for all involved. At ground level that means:

- non-invasively monitor and action critical content delivery

- spot and action potential allocation hotspots

- spot and action potential content hotspots

Using CRISP™, the IMO becomes the clearinghouse and custodian for the most problematic content type – cross-functional and cross-entity. Specifically, contributor produced and consumed deliverables, also known as the Nexus Point Content described in Post #6. Reducing noise by achieving very granular visibility into this critical data, the IMO gains real-time High Fidelity Observation into the workings of the initiative.

Achieving that visibility by deploying the Method, the IMO is able to easily:

- Facilitate communication across all involved parties: Buyer, Seller, and Advisors.

- Ensure alignment and compliance with: the original deal terms and conditions, execution cost and expense recapture goals, cultural integration, and operational continuity.

- Oversee the critical elements of getting things done.

Conclusion

The design of CRISP™ directly addresses the unique characteristics that affect M&A transactions. Enabling the IMO to concentrate on managing information that is known to be problematic, adds value to the initiative by way of:

- Speed (optimized communication flow)

- Quality (reduced miscommunication)

- Cost (mitigated rework; efficient work allocation; reduced admin burden)

IMO’s play a critical role in keeping integrations on track with speed and accuracy. CRISP™ amplifies this through structured communication and accountability.

Building on the notion of individual contributors’ impact on the initiative, next week’s post describes how poor or non-existent accountability is effortlessly brought front and center with CRISP™.

Thanks for reading! If this post has sparked any new ideas or questions about how to optimize your M&A integrations, I invite you to join one of my live intro sessions. Each session is 30 minutes and limited to 2 participants for an interactive, in-depth look at how the CRISP™ method can make your next integration faster, better, and more efficient.

📅 Register here -> CRISP™ Intro Sessions

✉️ Want to stay updated on future posts and sessions? Opt-in for exclusive updates: CRISP™ site

Let’s continue the conversation and dive deeper into a transformative approach to successful M&A execution!

CRISP™ is a pending trademark of Exertus, Inc.